This is in continuation of the Bitcoin series where we had discussed the technicalities of what a Bitcoin blockchain is and how it helps us do decentralized, trust-less transactions. In the next series of blogs we shall understand why Bitcoin came into being and its motivation. We will need to understand the financial working of the world, I will make it simple and hopefully an interesting read. So let us jump in with the first question

What is money?

We do not ask this question often enough, do we? In fact it is good that we do not ask, for if we understand the fiat system, we may freakout! Let us go back time and understand how money came into being

Let us assume that you are a farmer harvesting rice; you need some vegetables, so you trade some rice with a vegetable farmer. You then wish to buy some cattle, so that it is easier for you to sow your seeds. You get into an agreement with a trader who sells cows and you trade a few sacks of rice for a cow. This system of exchange of goods for goods is called barter system, however as you can see this is a complicated and inefficient system. If you wanted to own a piece of land but the owner did not want rice in exchange, then you would need to find someone who would buy your rice and provide the material which the seller would be interested to exchange

To solve this, humans tried anchoring value of goods against a precious commodity. For example, sea shells were used in geographies far away from the sea as a common trading commodity

Sea shells were not used in places which were closer to the sea as there is no scarcity in sea shells and anyone could find them in abundance

Therefore for something to be used as money i.e. store of value, it had to be scarce & precious

Overtime people started using precious metals such as bronze, silver and gold. For something to be a store of value, it will need to satisfy these characteristics

It has to be

1. Durable: it should not be perishable or easily destroyed

2. Portable: easy to carry around

3. Fungible: interchangeable with one another

4. Verifiable: easy to verify the authenticity

5. Divisible: able to subdivide to smaller units

6. Scarce: not easy to obtain

Value of money

The first signs of usage of gold and silver coins can be traced back to modern day Turkey (then known as Lydia) way back in 700BC. At that time, one Lydia coin was made of 8 grams of gold. In the first century AD, the coins of the Roman Empire were called Denarii and they weighed 3.4 grams and contained 80% silver, which had already lost purity from Caesar’s time. As time went, they continued devaluing the Denarri to about 5% of silver per coin

The act of cheapening the money reduces the trust in the currency & has caused empires to fail

In 1252, Florentine’s gold florin was minted and was about 3.5 grams of gold and since there was no devaluation done across decades, florin became an international monetary standard for the next four centuries!

Challenges in coin money

The coin as a form of money had few challenges, for one the velocity of transfer was less i.e. money changing hands; the other was the risk associated in transferring the coins. Imagine the days when shiploads of gold had to be transferred to settle trades & the high risk of pirates in the high seas

This was when deferred settlement was invented as a remedy to frequent transfers

Layers of money

As we saw so far, for money to be useful, the velocity of money should increase, thus the different layers of money came into being. It all started in the fourteenth century with the invention of double entry accounting system, which we use even today! We will come to this shortly. Let us see how the monetary system evolved

Back in those days, as a trader, you could give your gold to a goldsmith and in return the goldsmith provided you a certificate with a maturity date, at which time the bearer could redeem the deposited gold. This gave you the flexibility to easily carry around your “gold” and trade. However as of then, the Bills of exchange were not standardized and the maturity dates too were different

This solution also brought in the counter party risk i.e. what if the goldsmith did not honor his commitment to return the gold on submission of the paper? This risk exists even today in all forms of currency (except in Bitcoin)

In 1531, the Antwerp Bourse developed the concept of money market trading. Traders from all over Europe traded their assets from spices to cloth to all other commodities. The Bills of exchange were used to settle the dues. For easy settlements, the bankers invented Promissory notes to settle the daily outstanding balances in the bourse where the bearer of the note was promised to be paid the mentioned amount

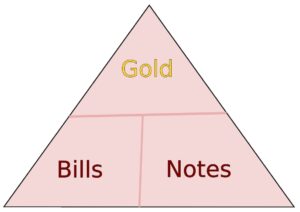

Thus we now had two layers of money, the first layer being gold and the second layer being Bills of Exchanges as well as Promissory notes, which were backed in full by the first layer of money

Debt as first layer

At the turn of seventeenth century the Dutch East India company (VoC) was setup where people could invest and get equity shares i.e. a common man could invest in the company and enjoy partial ownership. This lead to a lot of transactions of shares and the settlement methods had to be through advanced methods

As the second layer of money became universal, the Bank of Amsterdam (BoA) outlawed the cashiers and they were forced to submit all their precious metals to the Bank of Amsterdam, thus monopolizing the issuance of the second layer of money. This helped in faster and smoother settlement of transactions

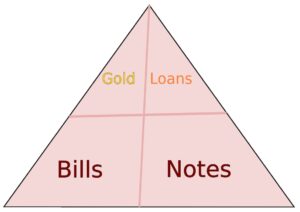

With the deposits that BoA had, it changed its role from a mere facilitator of financial settlement to lending. BoA lent money to VoC and classified the loan as an asset in BoA’s Balance sheet (the double entry which we discussed above); thus for the very first time creation of money through a Balance sheet and giving it the status of first layer of money alongside the metals was implemented. The money thus created at the second layer against the VoC loan was fractionally reserved i.e. if everyone had demanded for an exchange of their money to the gold deposits in BoA, they would not have been able to service it. Thus came into being the fractionally reserved fraught system

Eventually BoA eliminated the ability for people to exchange the money for the precious metals. By removing this, BoA depended on its own disciplinary constraint to stay sufficiently reserved

Third layer of money

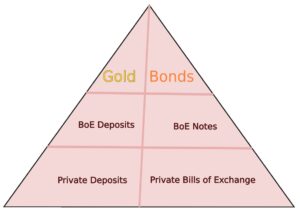

England too observing the success of Amsterdam started a similar reform and created the Bank of England and the release of pounds. As time went, private players got into this lucrative business and started offering deposits and Bills of Exchange. People could deposit money and earn interest while the Bank earned higher interest through loan settlements

Thus came into being the third layer of money i.e. if a person needed to convert their money to gold, they would have to go through three loops and each having its own counter party risks and each only being fractionally reserved

Since the money was only fractionally reserved, it was easier for central banks to create money and stimulate the economy

The devaluation of money did not end here, as time progressed the world hegemony changed from the Netherlands to England to the USA. We will see in the next blog how USA completely de-linked the gold as the first layer of money and its consequences as we see now

If you directly landed on this blog and would like to understand the technical side of the Bitcoin blockchain, then go ahead and read the blog series starting from here. If you want to understand in detail on the different layers of money & its transformation, you could read Layered Money by Nik Bhatia. If you want to understand how the world orders have changed and the cycles that happens every 100-150 years, then do read Changing the World Order by Ray Dalio. All of these are interconnected concepts